The political situation in Bulgaria (a NATO member state since 2004) is the most stable and predictable on the Balkans.

• Bulgaria is a party to 52 international agreements for the protection and stimulation of investments on a reciprocal basis, and to 55 agreements for avoidance of double taxation.

• As an EU member since 2007, Bulgaria’s legal framework is fully compliant with EU standards. In addition International Accounting Standards have been universally adopted in Bulgaria.

GDP Growth 2004 – 2013 – Source Bulgarian National Bank

• There is no tax on capital or on interest. Capital Gains Tax stands at 10% net. In a number of cases, it is even 0%, if the gains derive from the sale of assets donated by or inherited from parents.

• Corporate tax is 10% and it goes down to 0% in regions of high unemployment. Taxation on company dividends is 5% and there is no additional taxation on repatriation of the dividends to any EU member state.

• There is a liberal regime governing capital repatriation after taxes. For further information please contact our Legal and Taxation Department.

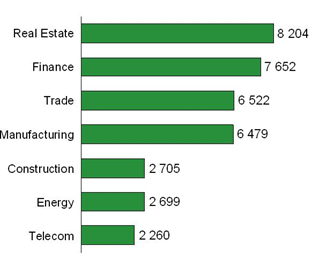

FDI flows by industry 1996 – 2011

• More than 80% of the FDI come from the EU countries.

• Before the crisis, investments were mainly in the sectors of real estate and finance, while in the last two years the tendence is for their redirection in production..

• Legal Entities (Companies and Corporations) fully owned by foreigners, but registered in Bulgaria, can buy and hold land and farm land. Non-Bulgarian individuals cannot buy land directly, but they can do so, through setting up Bulgarian companies, in which they may own up to 100% of the equity. From 2012 onwards, EU citizens are able to buy land directly.

Note: Since 01.01.2010 and the changes made in the Bulgarian Commercial law, the required minimum capital for company formation has been drastically reduced. Thus, the legal form of company known as limited liability company (Bulgarian O.O.D.) has become a really attractive and easily accessible way of doing business.

• Strategic Investments in Bulgaria exceeding €5 mn enjoy a number of tax and charge exemptions for land and property transactions. In all other respects foreign investors are treated equally to Bulgarians. When international agreements, to which Bulgaria is party, offer better treatment than the national legislation the former have precedence. The law also offers protection against nationalisation.

• The Liabilities and Contracts Act allows creditors to collect their receivables, as well as compensation for non-payment of liabilities.

• The Civil Procedure Code allows disputes to be taken to foreign courts, in case one of the parties is a resident of the foreign country.

Download Bulgaria – your investment decision presentation of Invest Bulgaria Government Agency or visit www.investmentinbulgaria.com